AI Credit Repair Just Got Better!

Say goodbye to credit repair guesswork! Dispute AI™ delivers personalized strategies to boost your credit score, backed by cutting-edge artificial intelligence. Your path to a stronger credit score starts here. Join thousands who trust Dispute AI™ to simplify credit repair and achieve their financial goals.

Our Benefit

AI-Powered Insights: Understand what’s impacting your credit and receive actionable, data-driven recommendations to improve it.

DIY Flexibility: No consultants, no stress—handle your credit repair on your terms, anytime, anywhere.

Fast Process

Data-Driven Confidence: Trust AI to quickly and precisely analyze your credit and guide you to smarter financial decisions.

Affordable

Never hire a credit repair company again! Get the results you want without paying thousands to agencies.

Solution

Discover the smarter, DIY solution to credit repair.Our innovative financial solutions are designed to optimize your credit and provide and arsenal of resources to rebuild.

Who We Are?

We Aim To Provide You The Best Financial Software & Tools!

At Dispute AI™, we bring over 20 years of expertise in credit repair and financial empowerment to revolutionize the way individuals take control of their credit. Our team of seasoned professionals has combined decades of industry knowledge with cutting-edge artificial intelligence to create a powerful, DIY solution that simplifies and streamlines the credit repair process. We are passionate about helping individuals achieve financial freedom, and our mission is to provide innovative tools that make credit improvement accessible, efficient, and impactful. With Dispute AI™, you’re backed by a legacy of trust, innovation, and proven results.

Tailored Financial Solutions

Expertise You Can Trust

20+

Years Experience

Dispute Strategies

Tailored AI-driven tactics to challenge and resolve inaccurate credit report items effectively.

Competitive Price

Achieve your credit goals without breaking the bank—premium results at an affordable cost.

Expert Support

Access guidance from seasoned credit professionals whenever you need it.

What Customers Say

Join thousands of satisfied users who’ve improved their credit scores with Dispute AI™.

ScoreBuilder AI transformed the way I looked at credit repair. I gained 60 points in just three months without spending a fortune!

Henry Smith

Raleigh, NC

So easy to use, and I love the real-time tracking! I finally feel in control of my financial future. Lol!

Rachel Lorenson

Minneapolis, MN

The AI insights are a game changer. I always knew I needed help, but this gave me the tools to fix my credit myself.

Michael Pratt

Pasadena, CA

Frequently Asked Questions

How does the service work?

When you sign up for our service, you must choose the items appearing on your credit report you feel are incorrect, unfair, or questionable. You then can contact your creditors to demand their removal or correction. If the creditors do not fix the mistakes, you can up the pressure and give new information as to why this item should be removed from your reports. Additionally, we provide recommendations of products such as low interest credit cards, personal loans as well as auto and home loans.

How much does your service cost?

There is no cost for the platform and access to templates, this is a free service. This business model may seem bizarre because we do not charge anything for our service, but it is - we truly do not collect fees for our DIY credit repair service. Everyone should monitor his or her credit and in order to help you, we offer you the ability to keep an active credit monitoring account with our credit report partner CreditStreak.com (Credit monitoring does have a cost of $29.95, and we cannot prevent them from collecting their fees and we do receive a referral fee). The purpose of the monitoring account is twofold. One, we need access to your credit in order to receive the credit information so you can begin working on your credit. And, two, it will allow them to monitor and inform you of any changes in your report as needed. The cost for credit monitoring is a small fraction of what you would pay a traditional credit repair company and it provides you with valuable insight and tools to keep an eye on your credit and improve it. While you are free to purchase a different 3rd party credit monitoring service, our platform has only been programmed to have the capability to automatically upload the details of credit reports and monitoring information via CreditStreak.com.

How long does the process take?

Credit Repair is a gradual process that requires, time, patience, and persistence. Many customers receive results within 30 to 45 days. The overall process can take six months to a year or longer depending on many different factors.

Why is this better than hiring a credit repair company?

Because it’s FREE! Even if you purchase the outside credit monitoring service to take full advantage of our free platform, you're saving much more than if you hired a third party credit repair company.

What type of items can you delete?

We do not delete anything from your credit reports. No one can predict that ANY item will be removed from your credit report and we don’t make any promises that you are able to get anything removed from your report. We can only give you the tools to best remove the items that are inaccurate, outdated or unverifiable. It is up to you to submit the forms you can prepare from our platform to your creditors and credit bureaus, they will determine whether matters need to be corrected or removed.

Do you guarantee I get approved for a home or auto loan?

Nope. Let us be clear, we do not guarantee any specific score improvement, and we definitely cannot promise you will be approved for financing of any kind. No one can. However by sending your dispute letters to the creditors and credit bureaus yourself, you may be able to remove errors and by removing those errors, it generally can have a positive impact on your credit score; but lenders take more than just your credit into consideration such as income, employment and other factors. By correcting inaccurate items in your credit report you will likely have a better chance at securing favorable terms.

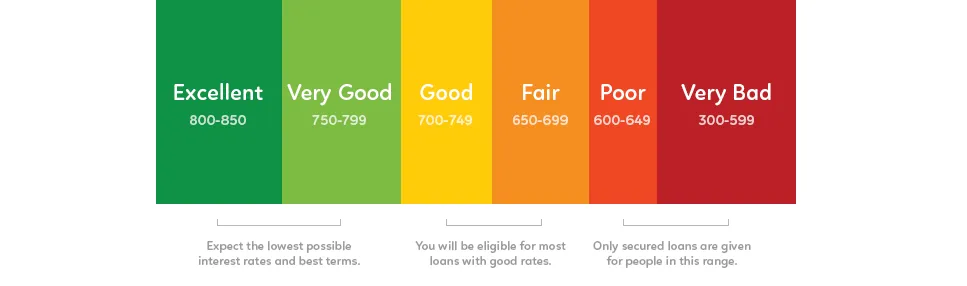

What is a credit report?

A credit report is a track record of both your personal and financial credit information. Which includes information taken from public records, personal identification and debt information.

What are the three credit bureaus?

A credit bureau - sometimes called a "consumer reporting agency" - is a business that collects relevant consumer information from creditors and courthouses, and then sells that information to interested parties such as potential lenders. Such information is sold in the form of a credit report. In the U.S., the three major credit bureaus are TransUnion, Experian, and Equifax.

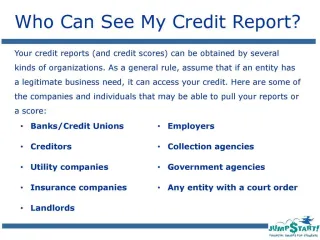

Who can see my credit reports?

If you are in the process of trying to get financing on a home, automobile, credit card, charge card or personal loan, any creditor who you are working with has the ability to pull your credit report, but only with your permission. This is called an inquiry. Employers may also review your credit file if you are applying for a job, especially if security clearance is a requirement.

What is the Fair Credit Reporting Act and why was it created?

The Fair Credit Reporting Act (FCRA) was written in 1970 as an amendment to the Consumer Credit Protection Act. The FCRA provides additional measures of consumer protection in the areas of fairness, accuracy, and privacy of the information collected by the credit bureaus. It also allows you to personally engage in credit repair and maintenance processes, verifying that the information in your credit report is correct.

Contact

1407 West Fremont Street, Suite D, Stockton CA 95203

(800) 641-7347